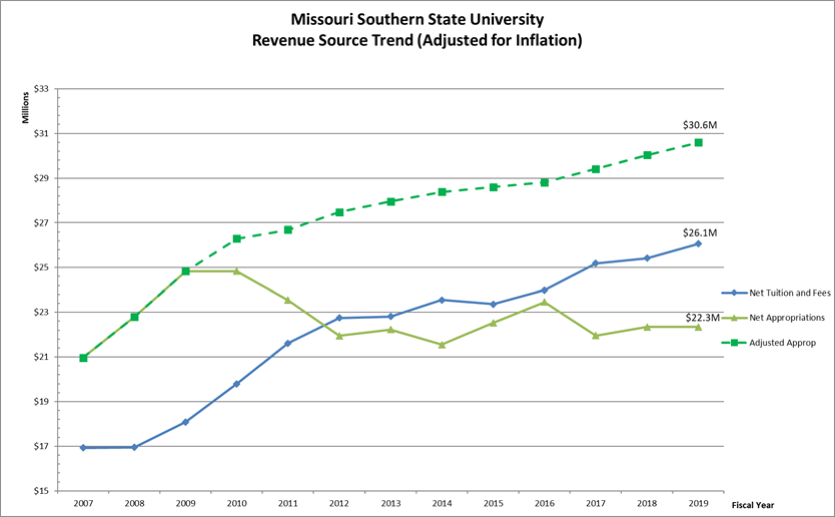

When Dr. Alan Marble was appointed interim President of MSSU in the summer of 2013, he faced a budget deficit of $2.3 million for the 2013-'14 fiscal year. Understanding that our reserves were being depleted and Southern was on a non-sustainable financial course, he formed the Financial Stability Committee. The committee, charged with putting MSSU’s finances on a sustainable path, was made up of two representatives each from the university’s Board of Governors, administration, faculty and staff. The dire financial situation the committee faced had a number of causes. State funding of higher education had been declining overall and we did not expect this trend to reverse. In 1972, state appropriations accounted for 68% of Southern’s revenue. In 2002, appropriations were down to 49% but still significantly higher than tuition and fee revenue. In 2011-12, tuition and fees exceeded state appropriations for the first time in university history (see where lines cross below). This trend has continued.

The chart above also shows what state appropriations would have been if they had kept up with inflation. When the state passed into law HB 2348 they restricted Missouri Southern’s ability to raise tuition faster than the rate of inflation without incurring a penalty. Other factors constrain the university’s ability to increase revenue. For example, we have a small endowment and local demographics don't call for large increases in high-school graduates. In short, Missouri Southern has been forced to move closer to a private school financial model as the state of Missouri continues to spend considerably less on higher education per citizen than any of our neighboring states.

After analyzing the university’s financial situation and considering several alternatives, the Financial Stability Committee came up with the idea of applying an open-book management system, using The Great Game of Business® as a guide. GGOB President Rich Armstrong and his associate, Rhonda Chapman, were very instrumental in helping MSSU begin the implementation of an open-book management system based on the book “The Great Game of Business” written by Jack Stack. We are very grateful to GGOB, Rich, and Rhonda for their assistance in starting us down the road to this groundbreaking initiative in higher education.

Over the course of our implementation of open-book management at MSSU, we discovered the system developed by The Great Game of Business® required extensive adaptation to be applied to the context of higher education. Some examples of the challenges we have faced include:

Additionally, decades worth of Gallup research measuring employee engagement indicates engagement in academic institutions is within the lowest quartile and faculty are less engaged than staff across the board. As a result of these differences, and the fact Missouri Southern had not fully implemented its open-book management initiative, we decided it was in our best interests to end our partnership with GGOB. This allowed the university to fully adapt the concept of open-book management to fit higher education and pursue the marketing of the Empowering U system to other institutions once it has been fully implemented.

Financial transparency is one of the fundamental concepts in open-book management and we have worked hard to translate MSSU's official, state-required financial reporting into something all employees can understand. This allows campus personnel to explore how they can impact critical financial and student success metrics. The translating of financial reports involved developing a University Dashboard showing the financial status of the university as a whole and each unit on campus: academic, support, and auxiliary. These dashboards are now available to all employees. To view the university’s financial dashboards, visit Open the Books.

Our training materials help ensure each employee understands not only the university’s finances, but how what they do every day impacts those finances and other critical student success metrics. This is where Process Improvement Challenges come in. Each academic and support unit on campus is empowered to determine how they can improve their critical metrics and develop challenges and dashboards that track their progress toward achieving these goals. We have an Empowering U Process Improvement Challenge subcommittee that provides assistance in developing effective challenges, including incorporating Six Sigma process improvement methods. Units who achieve their goals and improve their critical metrics through challenges may select to receive recognition and/or rewards. We have developed a Challenge Application process that allows individual units to seek advice on challenge design and apply for reward funding. Each unit determines, on their own, what they can do, how they can do it, and whether they want to be rewarded. When we have everyone on campus working to improve our critical metrics, great things happen, including the Lion's Share – our campus-wide reward based on our financial performance. To learn more about challenges, visit Process Improvement Challenges.

Due to our open-book management initiative, MSSU was able to improve its financial health which led to the university’s administration providing Lion's Share stipends to qualified full- and part-time employees in 2017, 2018 and 2019. Achieving this financial stability was Stage 1 of the Empowering U initiative.

Given this improved financial health, and after the development of the university’s new strategic plan and mission to “educate and graduate knowledgeable, responsible, successful global citizens”, the emphasis of Empowering U has moved to Stage 2: Student Success.

Every unit on campus has been asked to adopt the critical metrics expressed in our strategic plan subgoal 1a: Update and implement the strategic enrollment management plan to yield 2,000 freshmen and transfer student headcount and a 66% fall-to-fall retention rate by 2023. Units have also been asked to select other key metrics and work to improve those metrics through the use of process improvement challenges.

Given the unpredictability of state funding and enrollment trends, Southern will always have to work toward maintaining financial stability. Thus we now have two critical metrics: operating cash (a measure of financial health) and retention (strategic plan subgoal 1a). Our new emphasis on student success and retention have direct impacts on tuition revenue and our financial stability.